DFC - Dedicated Freight Corridor - A Game changer

Source: DFCCIL

DFC Video Link

Hqrs: New Delhi

2006 October - Incorporation of DFCCIL (Schedule”A”) Government Company, as SPV – Special Purpose Vehicle, is a wholly owned company of the Ministry of Railways registered under Company Act 1956.

· · Estimated Project Cost - Rs. 82,000 Crores (Approx)

· The Eastern & western dedicated freight corridors entail an investment of 12 billion dollars,

· Eastern Corridor - World Bank Loan of 1.86 Billion dollars (Rs. 13000 Crores)

· Western Corridor - JICA (Japanese International Cooperation Agency) loan of 5.2 Billion Dollars (Rs. 37000 Crores)

· The balance between Project Cost and Loan is borne by Govt of India through Equity.

Need of DFC

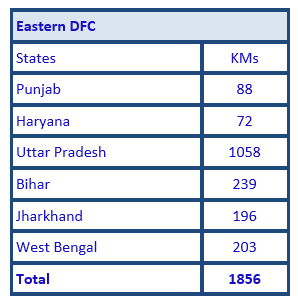

· Eastern Corridor ( EDFC ) from Ludhiana ( Punjab ) to Dankuni (Near Kolkata)

· Western Corridor (WDFC) from Jawaharlal Nehru Port, Mumbai to Dadri

near Delhi.

· The Delhi-Mumbai rail route and the Delhi –Howrah rail route are highly congested at present.

· IR has lost a significant portion of its Freight business to the Road sector and has planned to recover the market share through DFC.

Beginning:

· Golden quadrilateral connecting 4 Metropolitan cities of Delhi, Mumbai, Chennai and Kolkata and its diagonals 1. Delhi to Chennai and 2. Mumbai to Kolkata – Total route length of 10,000 Kms –

Share of Golden quadrilateral at present

Route | Passenger traffic | Freight traffic |

16 % | 52 % | 58 % |

· Line capacity varying between 120 % to 150 % in Eastern Corridor (Delhi to Kolkata) and in Western Corridor (Delhi to Mumbai) – Highly saturated

· IR lost its share in freight traffic from 83 % in 1950-51 to 30 % in 2018-19

· To meet the growth of Indian Economy in recent decades and to garner the share of Freight transport, the Govt mooted the conception of Dedicated Freight Corridors

· Beginning step in the above direction is the Presentation of Railway Budget in 2005-06.

· 2006 – A SPV (Special Purpose Vehicle) named Dedicated Freight Corridor Corporation of India limited was incorporated as a company under the Companies Act, 1956/2013.

Mission:

· To build a Corridor with appropriate technology

· To regain market share of Freight transport

· To set up Multimodal logistic parks along the DFC to provide complete solution to customers

· To adopt the Railways as the most environmental friendly transport mode

Salient Features

· Chairman : De facto Chairman, Railway Board

· Hqrs: New Delhi

· Total route length : 3360 kms

· Western Corridor : 1504 Kms From Dadri (UP) to JNPT -Jawaharlal Nehru Port Trust (Mumbai)

· Eastern Corridor : 1856 Kms From Ludhiana(Punjab) to Dankuni (West Bengal)

· The Railway’s share expected to go up from the present level 30 % to 45% in the Total transport sector

· It is exclusively for Freight trains. So it should be possible to run time-tabled trains with guaranteed transit time.

· Last mile connectivity – by tying up with truck operators. So that offered door to door services to the Customers.

· Setting up of Multimodal logistics parks along the Corridor to facilitate all kinds of value addition from packaging. Retailing, labelling, pelletizing etc.

· Design-Build Lump-sum Contract strategy – Construction of DFC. Being a design build contract bidder is supposed to quote lump-sum contract price for the total work including design, construction, testing, commissioning and liability during defect liability period. It is akin to EPC Projects. Click for Article on EPC in the blog.

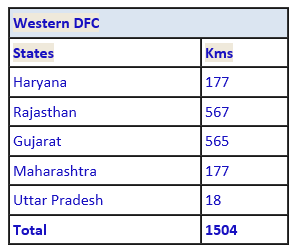

· Western corridor will cater double stack containers on electrified traction, which is first in the world

· RO-RO – Roll On Roll Off traffic – Western Corridor - to attract non-bulk traffic particularly at short lead to avoid cost of transhipment

Latest update on May 2022

EDFC - 1875 RKM From Ludhiana (Punjab) to Dankuni (West Bengal) covering Punjab, Haryana, UP, Bihar, and Jharkhand, West Bengal.

WDFC - 1506 RKM. From Dadri (UP) to Jawaharlal Nehru Port (Mumbai) covering UP, Haryana, Rajasthan, Gujarat, and Maharashtra.

Key points for MCQ

DFCCIL stands for Dedicated Freight Corridor Corporation of India Limited

Western DFC - From Dadri (UP) to JN Port (Mumbai)

EDFC - From Ludhiana (Punjab) to Dankuni (West Bengal)

WDFC - 1506 RKM

EDFC - 1875 RKM

RKM stands for Route Kilo Meters

DFCCIL Hqrs - New Delhi

Total Cost - Rs. 1,24,000 Crores

Relationship with Indian Railways:

· Concessioner is Indian Railways and Concessionaire is DFCCIL

· Period is 30 years (from commencement of operations)

· Accept freight trains on its track on payment of user charge called TAC – Track Access Charge by Indian Railways and other Private Train operators.

· Land will be acquired by IR under Railway Amendment Act, 2008 and leased to DFCCIL

· Financing the Project: Loan from External bilateral/ Multilateral funds recd via Ministry of Railways and equity contribution from the Ministry of Railways.

· Main source of Revenue to DFCCIL is TAC – Track Access Charge

· TAC consists of Fixed and Variable components. Variable component based on volume of traffic in terms of 000 GTKMs

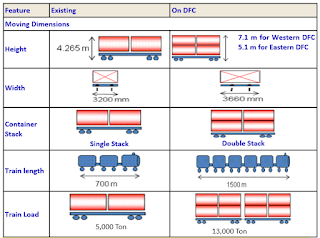

· Cost of construction of Double Line electrified Track – Rs. 18 Crores Per KM (in IR , it is Rs.12 Crores per KM). The reasons for increasing cost are

A. Electric traction of 2 x25 KV, 58hz single phase AC

B. Double line automatic signaling

C. Standard of loading of 32.5 Tonnes Axle Load

D. Will have grade separation from IR. Existing lines in the form of flyovers to ensure free flow of trains on both the systems.

Advantages:

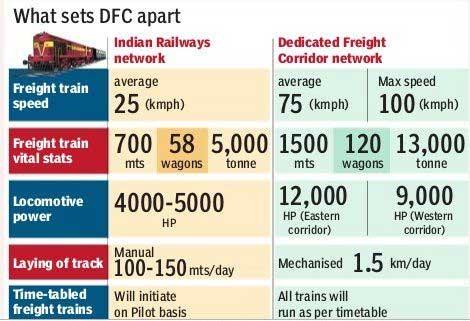

1. Bring about a paradigm shift in Freight operations

2. Reduction in the unit cost of transportation.

3. Higher speeds

4. Better turnaround of Wagons

5. Act as Catalyst for the Development of Industry and Areas along the Corridor.

6. Increased payload to tare ratio (by higher axle load wagons)

7. Improved SEC - Specific Energy Consumption

8. Ultimate objective is to reduce the O & M Costs (Operation & Maintenance)

9. DFC will save more than 450 million ton of CO2 in first 30 years of operation.

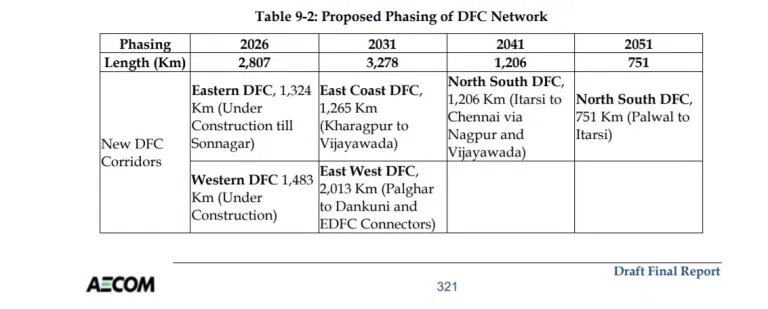

· Coming up Freight Corridors are

.

*****

OCC - Operation Control Centre

WDFC

At Ahmedabad

Operationalised in March 2023

Controls entire WDFC’s Train operations, Signalling, and Power Supply and monitor the health of Rolling Stock & Track Safety.

It is equipped with advanced technologies and new applications for Train operations.

SCADA - Supervisory Control And Data Acquisition operations

TPC - Traction Power Controller operations will be done from the OCC

Nerve-centre of WDFC - 1506 KMs - Double Track Electrified 2 x 25 KV From Mumbai JNPT (Jawaharlal Nehru Port Trust) to Dadri via Vadodara, Ahmedabad & Rewari, covering the States of Haryana, UP, Gujarat, Rajasthan, and Maharashtra.

Green Building

Serve the Round-the-Clock

EDFC

Going to be a launch

OCC - for EDFC - Prayagraj, UP - World’s Second Largest OCC

Command Centre for the entire route length of 1856 KMs of EDFC

Green Building rating of GRIHA4 - equipped with Solar power and rainwater harvesting

1560 Sq Meter with a video wall of more than 90 metres.

The Divyang-friendly one

Modern interiors, Best-in-class acoustics, ergonomically designed to suit the needs of the Traffic Controllers

Integrated SCADA with TMS (Train Management System) - will enable the Traction Controllers to monitor, control as well as remotely operate power supply equipment at Traction Sub Stations, Sectioning and Parallelling posts for the Entire Network.

Under the Make in India or Atma Nirbhar initiative, the system has been developed by Alstom, and supported by their design teams in Bangalore.

EDFC - 1875 KMs - Two distinct segments:

Double Track - 1409 KMs - Dankuni to Khurja

Single Track - 447 KMs - Khurja to Dadri

DFCCIL Network

State | WDFC | EDFC | Total | % Share |

UP | 19 | 1078 | 1097 | 32 |

Rajasthan | 567 | - | 567 | 16 |

Gujarat | 565 | - | 565 | 16 |

Haryana | 177 | 72 | 249 | 7 |

Bihar | - | 239 | 239 | 7 |

West Bengal | - | 203 | 203 | 7 |

Jharkhand | - | 195 | 195 | 6 |

Maharashtra | 178 | - | 178 | 6 |

Punjab | - | 88 | 88 | 3 |

Total | 1506 | 1875 | 3381 | 100 |

Key Points for MCQ

DFCCIL stands for Dedicated Freight Corridor Corporation of India Limited

OCC stands for Operations Control Centre

OCC - WDFC - Ahmedabad

OCC - EDFC - Prayagraj

OCC at Prayagraj - going to be launch - World’s Second Largest one

OCC at Ahmedabad - Operationalised in March 2023

SCADA stands for Supervisory Control And Data Acquisition

DFCCIL - 3381 KMs

WDFC - 1506 KMs

EDFC - 1875 KMs

UP covers - Highest Network of DFCCIL - 32 %

DFCCIL - Incorporated - in 2006 - as a Schedule A Company under the Companies Act, 1956

MCQ on DFCCIL

1. Headquarters of DFCCIL

Answer 1: Mumbai

Answer 2: Kolkata

Answer 3: New Delhi

Answer 4: Bangalore

2. DFCCIL is a ______

Answer 1: Registered Company

Answer 2: Government Organisation

Answer 3: Private company

Answer 4: subsidiary of World Bank

3. Target for completion of Dedicated Freight Corridor

Answer 1: 2022 December

Answer 2: 2021 December

Answer 3: 2023 June

Answer 4: 2024 December

4. Estimated project cost (approx) of DFC

Answer 1: 1.24 lakh crore

Answer 2: 2.24 lakh crore

Answer 3: 3.24 lakh crore

Answer 4: 4.24 lakh crore

5. DFC project cost financed by _________

Answer 1: World Bank & LIC

Answer 2: JICA & LIC

Answer 3: World Bank and JICA

Answer 4: World Bank, JICA & Asian Development Bank

6. IR lost its share in freight traffic from ___ in 1950-51 to ____in 2018-19

Answer 1: 83 % , 30 %

Answer 2: 95 % , 55 %

Answer 3: 83 % , 53 %

Answer 4: 63 % , 30 %

7. TAC stands for _______ (DFCCIL)

Answer 1: Travelling Access Charge

Answer 2: Track Access Component

Answer 3: Track Access Charge

Answer 4: Track Activation Charge

8. DFCCIL established in the year

Answer 1: 2006

Answer 2: 2016

Answer 3: 2010

Answer 4: 2012

9. Chairman of DFCCIL is

Answer 1: Prime minister

Answer 2: Railway Minister

Answer 3: Member/Finance

Answer 4: CEO & Chairman, Railway Board

10. Dedicated Freight Corridor is meant for

Answer 1: Passenger trains and Freight Trains

Answer 2: Exclusive for Freight Trains

Answer 3: Exclusive for Passenger Trains

Answer 4: Priority for Freight Trains. But can allow Passenger Trains

Answers;

3

1

3

1

4

1

3

1

4

2

%%%