M&P Programme

Source: 10th Chapter of Rolling Stock Code Click for Rolling Stock Code

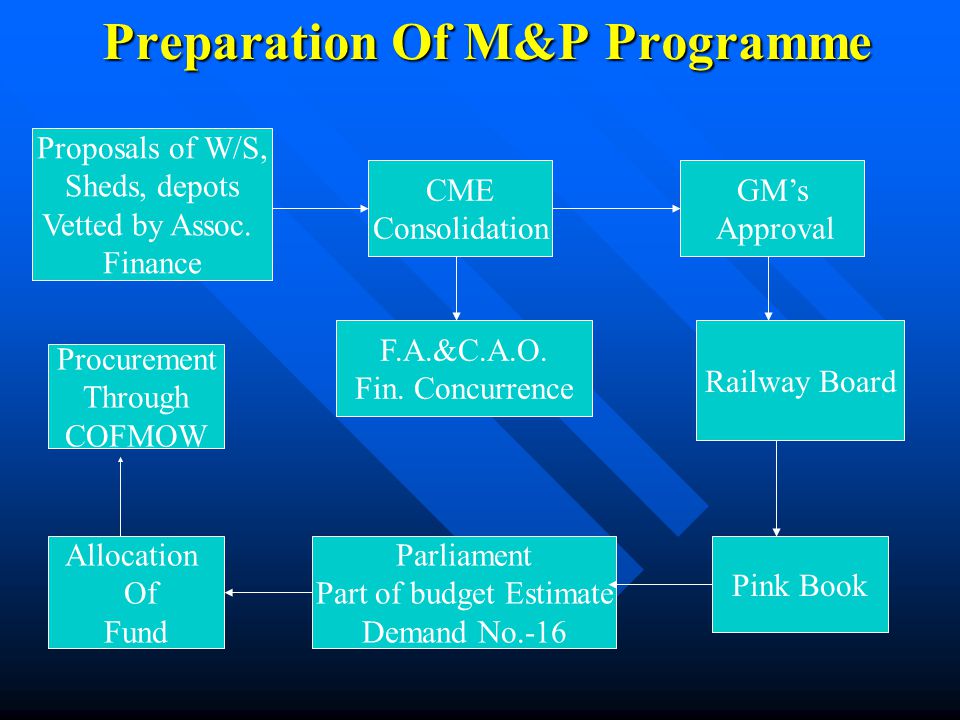

·

Investment decisions relating to

the creation, acquisition and replacement of assets on the Railways are

processed through the 3 different Programs

· They are

1. Rolling Stock Program (Plan Head 21)

2. M & P Program (Plan Head 41 )

3. Works Program (Rest of the

Plan Heads)

·

Click for article on Works Program

·

Click for article on Rolling Stock

Program

·

Plan

Head 41 - covers M&P items (under RB

& GM powers)

·

2020-21

M&P Grant - Rs. 487 Crores

·

Nodal

Officer - PCME (for budget allotments

& utilization of funds). He

is nodal officer for distribution of Ceiling (preliminary M&P Programme)

among various depts. The overall ceiling

should, however, be followed strictly.

·

Machinery and Plants are expensive

assets both to acquire and maintain.

Hence, it is important that investments in M&P shall be made

thoughtfully.

·

Items proposed under GM’s Out of

turn sanctions should not be included in the regular M&P Programme for

Board’s sanction.

·

The monetary limits for submission

of preliminary M&P proposals to Railway Board are revised from time to

time.

M&P Portal

·

Website address: http://www.irmnp.com/

·

Developed to allow easy creation

and processing of M&P proposals by users on Indian Railways.

Salient features of Portal

1. Can create proposals in

minutes and refine them as needed.

2. Users can stay ahead of all the deadlines.

3. Submit the proposals electronically to Zonal Hqrs and Railway

Board within no time.

4. Can track the sanction of

proposals issued by the Railway Board.

5. Tracking the status of procurement (by COFMOW)

6. Submit information about WIP - Works in Progress and receive funds

accordingly.

7. Keep the Asset Register updated automatically.

8. User ID and Password of

users by CME(Planning) of Zonal Railway/PU.

Preliminary M&P Program

·

Items included are (Figures may vary from time to time. Please

check latest amendments to Model SOP)

ü Rs. 50 lakhs above - each item

ü Rs. 30 lakhs above - each

item (Electronic in motion weigh bridges)

ü All Road vehicles irrespective of cost (Exception is sanctioning

of procurement of two wheelers under M&P– under GMs powers)

·

Submit consolidated Preliminary

M&P Programme through M&P Portal

maintained by Railway Board.

·

Estimated costs of the machines

indicated in the proposals should be present day realistic costs and should

include cost of essential accessories.

·

The present day cost - adopt from

1. The latest compendium issued by COFMOW 2. M&P Portal

·

Costs for other machines may be

obtained through market surveys.

·

Preliminary M &P Due Date: September / October month of every year or

date specified by the Railway Board.

After which, the portal would disallow any subsequent submissions.

·

Final M&P Due Date - Discussed

with the Railways by the Railway Board during December or January of every year

End-loaded

expenditure :

·

In other works, there is steady

outflow of cash as the project advances, and the trend of expenditure is

uniform.

·

But, in case of M&P

procurements the booking starts only after a machine is dispatched and hence

the expenditure is end- loaded.

·

With an average lead time of 3

years, the value of W.I.P items is often therefore more than 3 times the budget

sanctions.

Difference between M&P and T&P

M&P -

Machinery & Plant covers:

ü A machine that remains stationary and immovable.

ü That means job comes to machine and not vice versa.

ü All vehicles such as staff cars, Lorries, Diesel utility vehicles,

Road mobile Cranes, Front end loader/JCB cranes & Fork lifts.

T&P - Tools & Plant covers:

ü All movable machines like pneumatic drills, power saws, tools

& plants such as jigs and fixtures.

ü Small tools and equipments required for maintenance of machines

ü All measuring instruments / Gauges (irrespective of their unit

cost)

ü Upkeep of office such as

furniture, computers, printers etc.

ü Limit for Tools and Plant -

Up to Rs. 10 Lakhs each - Charged to Revenue.

If it is Rs. above Rs. 10 lakhs, procurement of such T&P is

processed under M&P.

Codal

life:

· Subject to modification from time to time as amended in Accounts

Code.

· It is merely an average economic life, assumed for the specific

purpose of making long term planning for replacements.

· Normally condemnation should be on age and condition basis.

· Condition basis arrived by derivative/derived of hours usage

(double or single shift), load factor, maintenance standards etc.

Annexure 10.2

of Chapter 10 of Rolling stock code.

|

S.No |

Codal life of machines |

Average Life in Yrs |

|

1. |

Machine Tools like Lathes,

Planners, Drilling, Boring and Milling machines etc. |

15 |

|

2. |

High Precision and special

purpose machine like wheel lathes etc. |

15 |

|

3. |

Tool Room and Testing Laboratory

equipment |

15 |

|

4. |

Foundry and Forge Equipment |

15 |

|

5. |

Heat Treatment Equipment |

15 |

|

6. |

Cranes – E.O.T |

25 |

|

7. |

Power Generation Machinery &

Switches |

15 |

|

8. |

General purpose light machinery

e.g. band saws, floor grinder etc. |

10 |

|

9. |

Air compressor |

15 |

|

10. |

Miscellaneous machines e.g.

light cleaning machines, test equipment in diesel sheds, workshops, depots

and sick lines |

15 |

|

11. |

Construction Machinery |

15 |

|

12. |

Track Maintenance equipment |

20 |

|

13. |

Station machinery e.g. weighing

machines etc. |

15 |

|

14. |

Miscellaneous machinery and

equipment for hospital, offices etc. |

10 |

|

15. |

Mechanical Weigh Bridges |

15 |

|

16. |

Electronic-In-Motion Weigh

Bridges |

08 |

|

17. |

Diesel Pumps |

10 |

|

18. |

Welding equipment including

diesel welding sets |

10 |

|

19. |

Diesel refrigeration equipment |

15 |

|

20. |

Material handling equipment like

FLT, Lister trucks etc., |

10 |

|

21. |

Traversers |

25 |

|

22. |

Fuel station dispensation

equipment |

10 |

|

23. |

Bulldozers and other earth

moving equipment |

15 |

|

24. |

Motor Boats |

10 |

|

25. |

Hydraulic re-railing equipment |

15 |

|

26. |

Staff cars including Jeeps |

07 |

|

27. |

Light Motor vehicles |

10 |

|

28. |

Heavy Motor vehicles |

10 |

|

29. |

Tractors |

10 |

Creation of new assets on Additional account

·

Proposals should be supported with Financial

justification and Rate of Return (10%) (Chargeable to Capital)

·

Vetted by Associate finance

·

Vetting is not required for machines required on

safety considerations such as medical/safety

equipment for ART/ARME (chargeable to DF IV)

·

Other particulars such as Reduction in cycle time,

improved quality and reliability, reduction in monotony etc should indicate in

the proposal.

Replacement

proposals:

·

Chargeable to DRF

·

Proposing one-to-one replacements

should be avoided, unless

·

The requirements of the proposer

have remained unchanged since the original equipment was acquired and

·

Machines of higher productivity

and reliability cannot be economically justified.

The following

details - spelt out in the replacement proposal:

1.

Codal life of the machine and

actual years worked along with the number of shifts per day.

2.

Jobs undertaken and the workload

for the machine.

3.

If reconditioning of the existing

machine or outsourcing was considered and the outcome.

4.

Total number of similar machines

in the load-centre and shortfall in capacity.

5.

Economics of acquiring one or two

machines to replace a larger set.

6.

Replacement proposed should be

substantially for same function and differences, if any, should be clearly

brought out with reasons.

7.

The cost of replacement may be

compared with original equipment and reason for any abnormal increase

explained.

8.

Proposals for Road vehicles should

accompany survey committee report comprising the condition of the vehicle,

expenditure incurred, mileage and recommendation.

9.

Reconditioning or Replacement: There

are situations where partial/ full reconditioning of machine is financially

more viable in comparison to its condemnation and replacement.

Master Plan:

·

For utilization of space &

Layout in Workshops/Repair Sheds.

·

Every Workshop or Repair Shed should

have a Master Plan pinpointing locations of the machine to be procured in

additional / replacement account in future.

·

So that, as and when new machines

are acquired, these should straight away get installed according to this master

plan.

·

Critical review of 20 Years and

above Machines and Over aged machines

incl: Cranes for their continued retention, so that floor space is effectively utilized. Retaining them only after a clear

certification of the in charge Officer duly certifying the sufficient load

exists for the same.

Works in Progress (WIP) Statement

·

Sanctioned and for which vetted

indents are submitted, but not completed or closed.

·

Should state the status of

procurement.

·

In absence of any clear indication

of procurement, funds should not be allotted.

·

Due date: 15th December every

year.

·

Funds projection - through M&P Portal maintained by

Railway Board.

Summary

- Top of the WIP Statement

1.

Costing Rs. 2.5 Crores and above each

2.

Costing below Rs. 2.5 Crores each

3.

Sanctioned under GM's Powers ( However list of items need not be sent to

Railway Board)

Budgeting

:

·

Validity of Sanction - 5 Years

- sanctioned under M&P

·

Validity of Sanction - 3 years

- Sanctioned under GM's OOT powers

·

Above 2.5 Crores each itemised in

Pink Book with Pink book number, allocation wise breakup separately

·

Allotment of M&P items - Less

than 2.5 Crores each and sanctioned under GM's OOT powers - distribution by the Nodal Officer

i.e., PCME and itemised in the LAW -

List of Approved Works with a unique LAW number.

Four Categories - M&Ps

Category

A

·

Sophisticated and unique machines

requiring extensive market survey

·

Specialized knowledge of the World

of machine tools.

·

Procured by COFMOW only.

Category

B

·

Machines like EOT cranes, welding

machines, compressors, Road Mobile Cranes, Diesel Gensets etc., that figure

frequently in the M&P Programs

·

Carefully procured, duly

eliminating unreliable vendors from a highly competitive market

·

Requirements

from Zonal Rlys are in bulk.

·

Entering into Running / Rate

contracts for 2 to 3 years with price variation clause

·

Consider ILM option - Install, Maintain & Lease like construction companies hire cranes on

long term basis

·

Procured by COFMOW only.

Category

C

·

Special machines of unique and

sophisticated nature for which domain knowledge may not exist with COFMOW

·

Requirements

are not in bulk

·

Procured by Zonal Railways but

after seeking dispensation from COFMOW well in time.

Category

D

·

Other machines of smaller value

below a certain limit barring certain excluded items, as stipulated by RB.

·

Medical equipment whose

procurement is best left to the user Railway.

Notes:

1.

M&P items costing up to Rs. 30

Lakhs each can be procured by Zonal Railways/Production units on their own,

without seeking dispensation from COFMOW subject to the exception list issued

by COFMOW and items covered under Rate contracts of COFMOW.

2.

Medical items equipments can be

procured by Zonal Railways/Production units.

Budgetary

Reviews:

·

PCME is Nodal Officer - He/She

will critically review these projections recd from Depts and submit to PFA duly

giving the reasons for allocation wise variations with the Budget Grant during

the budgetary stages.

Asset

Register of M&P:

·

On procurement, a unified 9 digit

code number to be allotted for each machine.

·

On successful commissioning of a

new machine, it is included in teh Asset register with all the details.

·

No machine shall be kept in

service without Unified Code Number, which is prominently painted on it for

easy identification.

·

On disposal (condemnation) or

transferred to Other Railway, the same is removed from the Asset Register of

Parent Railway.

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

Unit |

Sub

Location |

Machine

Group |

Individual

machine No. |

|||||

|

ICF/Division |

Shop

like Machine shop |

Wheel

Lathe, Cranes etc |

|

|||||

Likely

Descriptive Questions

1. Essay question on M&P Progrramme

2. Short Notes questions on A. Differences between M&P and

T&P B. Master Plan C. M&P Portal D. Asset Register of M&P

Material for MCQs - Multiple

Choice Questions

1. Nodal Officer for M&P Programme in Zonal Railway - PCME

2. Validity for RB Sanctions -

5 years

3. Validity for GM Sanctions - 3 years (OOT - Out Of Turn)

4. Unified code - 9 digits

5. Categories of M&Ps - for M&P Programme - 4

6. Dispensation of COFMOW not required - up to Rs. 30 Lakhs

7. Plan Head for M&P - 41

8. GM's Powers - M&P - up

to Rs. 50 Lakhs

9. GM's Powers - Electronic Weighing Machine - Up to Rs.30 Lakhs

10.

Sanctioning of Two Wheeler for RPF

post - by GM

11.

T&P item up to Rs. 10 Lakhs -

Charged to Revenue

12.

T&P item - Rs. 10 Lakhs and

above processed as M&P and charged to erstwhile Demand No.16 (DRF/CAP/DF)

13.

Medical equipments - of any cost -

Procured by Zonal Raiways

14.

Rs. 2.5 Crores and above -

itemised in Pink Book

15.

Below Rs. 2.5 Crores - included in

the LAW - List of Approved Works

16.

LAW Full form - List of Approved

Works

17.

WIP Full form - Works In Progress

18.

With an average lead time of 3

years, the value of W.I.P items is often therefore more than 3 times the budget

sanctions.

19.

All Road vehicles Proposals

irrespective of its cost to be included in the M&P Programme (except Two

Wheelers, which can be sanctioned by GM)

20.

Vetting of Associate finance is required

for all M&P Proposals of New Assets on Additional Account (Except for

Safety and Medical equipments - charged to DF)

******